Deductions In New Tax Regime For Ay 2024-25 – Section 80C deductions for New Tax Regime Preeti from 30% to 25% and increase the income threshold for this highest rate from Rs 15,00,000 to Rs 20,00,000. Also read: Budget 2024 LIVE Updates . Her work has been featured in Yahoo Finance, Bankrate.com, SmartAsset, Black Enterprise, New Orleans standard deduction amounts for the 2023 tax returns that will be filed in 2024. .

Deductions In New Tax Regime For Ay 2024-25

Source : twitter.comHow to adjust Long Term Capital Gains against Basic Exemption Limit?

Source : www.relakhs.comDeductions in New Tax Regime 24 25 | New tax regime 2024 | New tax

Source : www.youtube.comOld Tax Regime v/s New Tax Regime after Budget 2023 Income Tax

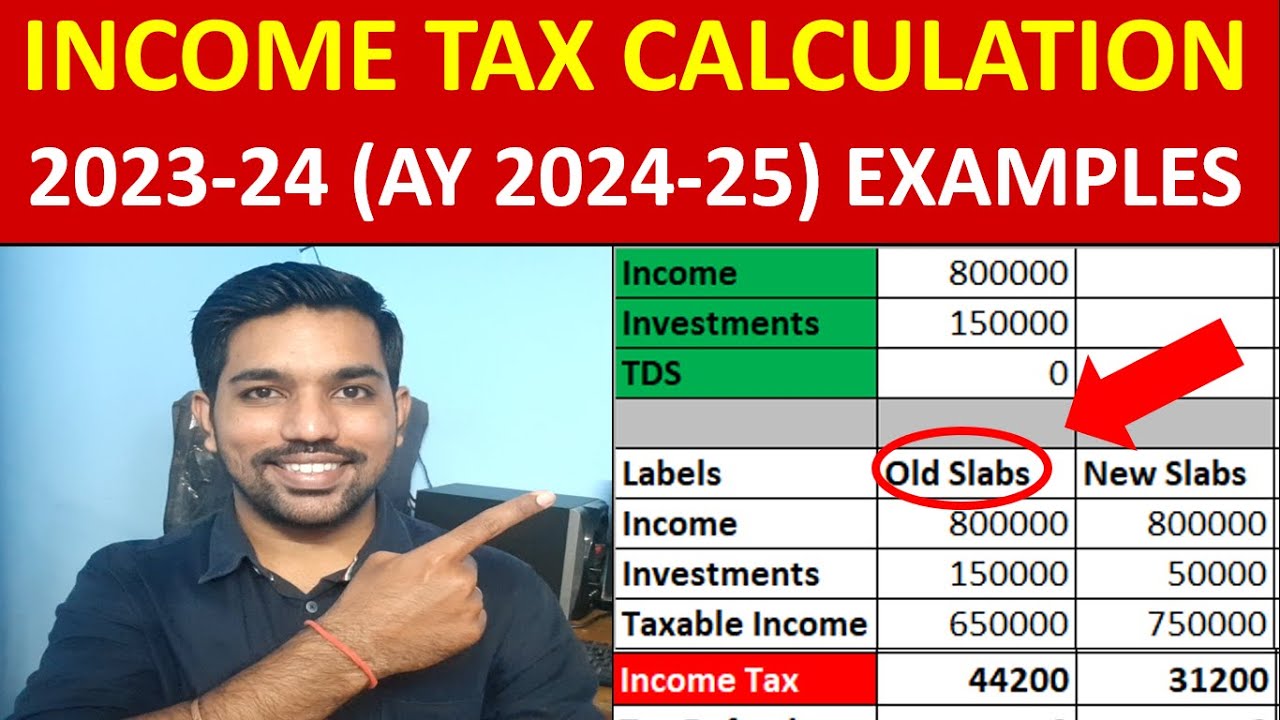

Source : qna.taxHow to Calculate Income Tax 2023 24 (AY 2024 25) | Tax Calculation

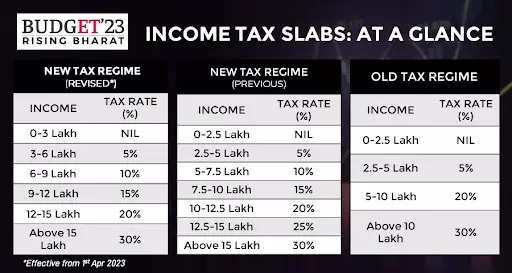

Source : www.youtube.comIncome Tax Slabs FY 2023 24 and AY 2024 25 (New & Old Regime Tax

Source : cleartax.inTax calculation on salary income AY 2024 25 | Standard Deduction

Source : m.youtube.comIncome Tax Slabs FY 2023 24 & AY 2024 25 (New & Old Tax Slab)

Source : www.etmoney.comDeductions in New Tax Regime 24 25| New tax regime 2024|New tax

Source : m.youtube.comIncome Tax Calculator 2023 New Tax Slabs 2023 24: Calculate

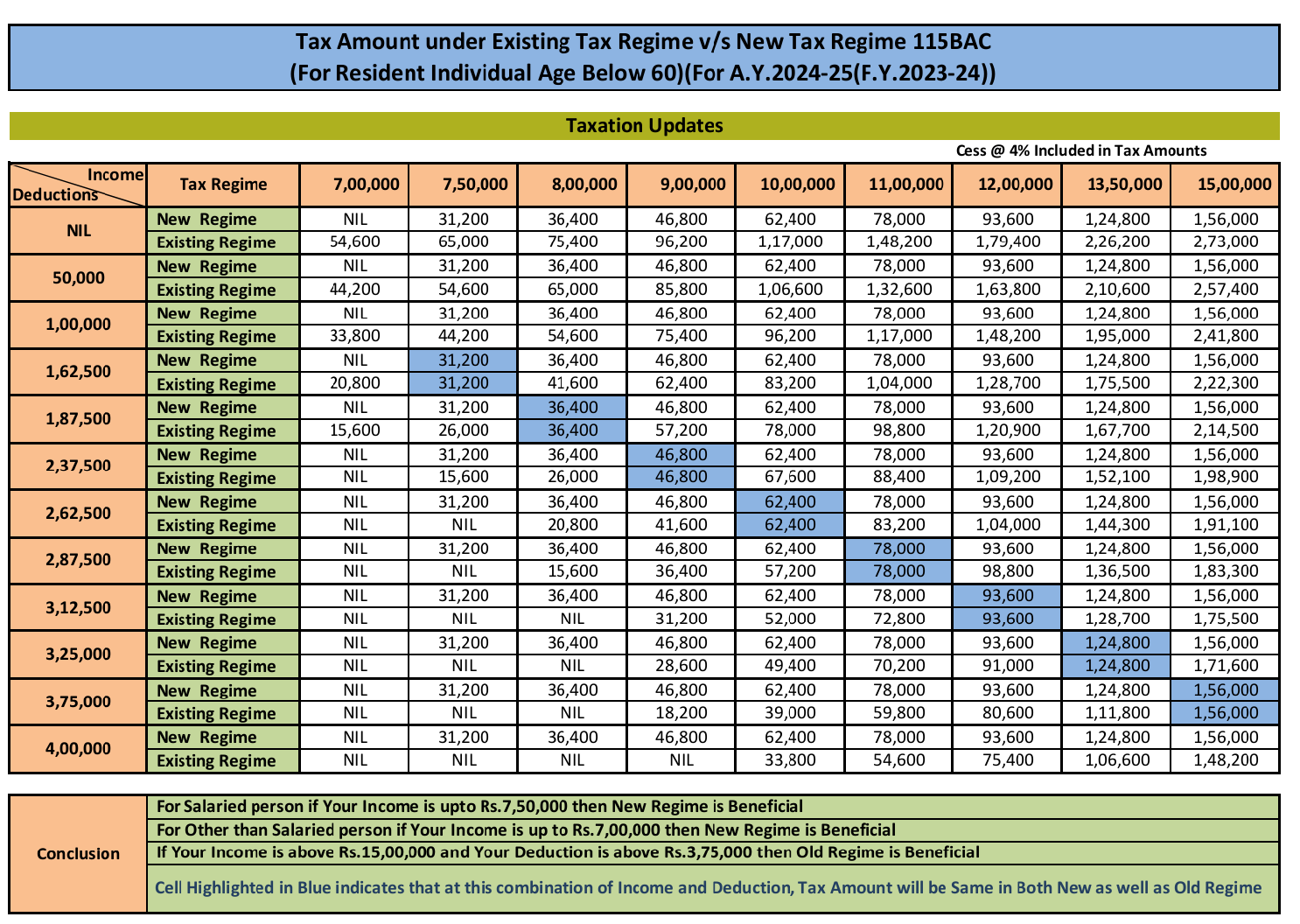

Source : economictimes.indiatimes.comDeductions In New Tax Regime For Ay 2024-25 Taxation Updates (Mayur J Sondagar) on X: “Which Regime to be : The standard deduction amounts tend to increase slightly each year to adjust for inflation. So let’s take a look at how much you can claim in 2024 for in a new tab) With tax season underway . India’s Income Tax Department has released ITR Forms 1-6 for AY 2024–25 ahead of schedule to assist taxpayers and enhance filing convenience. .

]]>